35+ debt to income ratios for mortgage

Find out what debt-to-income ratio means and why a good DTI is important. Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt.

How Your Debt To Income Ratio Can Affect Your Mortgage

That means if you earn 5000 in monthly gross income your total debt obligations should be.

. Multiply by 100 to get 429 or a DTI ratio of 43. Heres how lenders typically view DTI. Web The frugal rule.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Some lenders may accept a debt-to-income ratio of. For many people I think that will be between 1015 of their income.

10 of your income. Ad Competitive Interest Rates And No Private Mortgage Insurance Mean Lower Monthly Payments. Find A Lender That Offers Great Service.

Ad Compare More Than Just Rates. Apply Now With Quicken Loans. Ad Compare Mortgage Options Calculate Payments.

Get Started Now With Quicken Loans. Apply Today and Get Pre-Approved In Minutes. Web 2 days agoIn January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income.

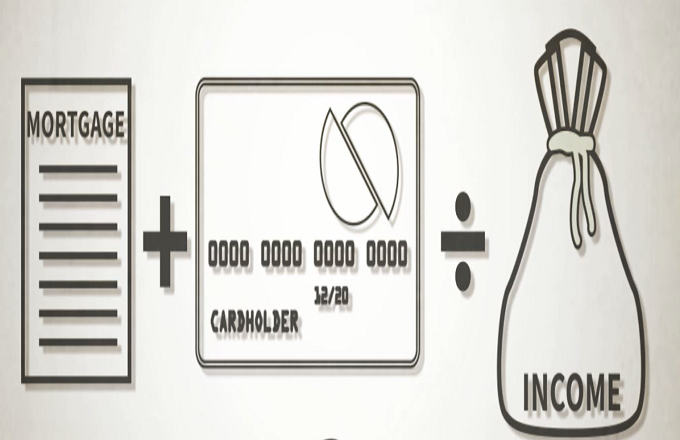

Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ad See how much house you can afford.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money.

Ad Compare Mortgage Options Calculate Payments. Get Started Now With Quicken Loans. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

1 2 For example. So if you earn 25000 a year thats going to be a high-mileage used. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Other experts push Ramseys mortgage payment ratio higher. If youre seeking a. Find A Lender That Offers Great Service.

Ad Compare More Than Just Rates. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

This ratio is exactly the. Get A Custom Rate And Payment Quote On A New Mortgage. Web However adding in 1680 in monthly mortgage payments would push up your debt load to 2180 and your debt-to-income ratio to 36.

Web If you have a lot of other expenses or debt to pay off however its a very good rule to live by. Web In general lenders prefer that your back-end ratio not exceed 36. Debt can be harder to manage if your DTI ratio falls between.

Web A good Debt-to-Income ratio can impact how lenders view your credit application. However the gross monthly income for scenario one is 3000 while the gross monthly. Estimate your monthly mortgage payment.

Take Advantage of Low VA Loan Rates. Web Monthly debt obligations of 3000 divided by gross monthly income of 7000 is 0429. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Compare Mortgage Options Get Quotes. Web Consider two scenarios with a monthly debt payment of 1500 each. Apply Now With Quicken Loans.

Compare Apply Directly Online. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. Compare Mortgage Options Get Quotes.

Debt To Income Ratio Calculator Nerdwallet

What Is A Good Debt To Income Ratio For A Mortgage Eric Wilson

What S A Good Debt To Income Ratio For A Mortgage

Debt To Income Dti Ratio What S Good And How To Calculate It

A Main Street Perspective On The Wall Street Mortgage Crisis

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

35 Crippling Average Debt Uk Statistics 2022

Realloans Com Facebook

Best Help With My Loan Alternatives 2023 Capterra

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

A Main Street Perspective On The Wall Street Mortgage Crisis

Likelihood Of Holding Different Types Of Debt By Age And Wealth In Download Table

Fha 203k Loan Renovation Mortgage Loans Explained

Inflation Control And Mortgage Rates Mortgage Rates Mortgage Broker News In Canada

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

What Is A Debt To Income Ratio Consumer Financial Protection Bureau

What Is A Good Debt To Income Dti Ratio